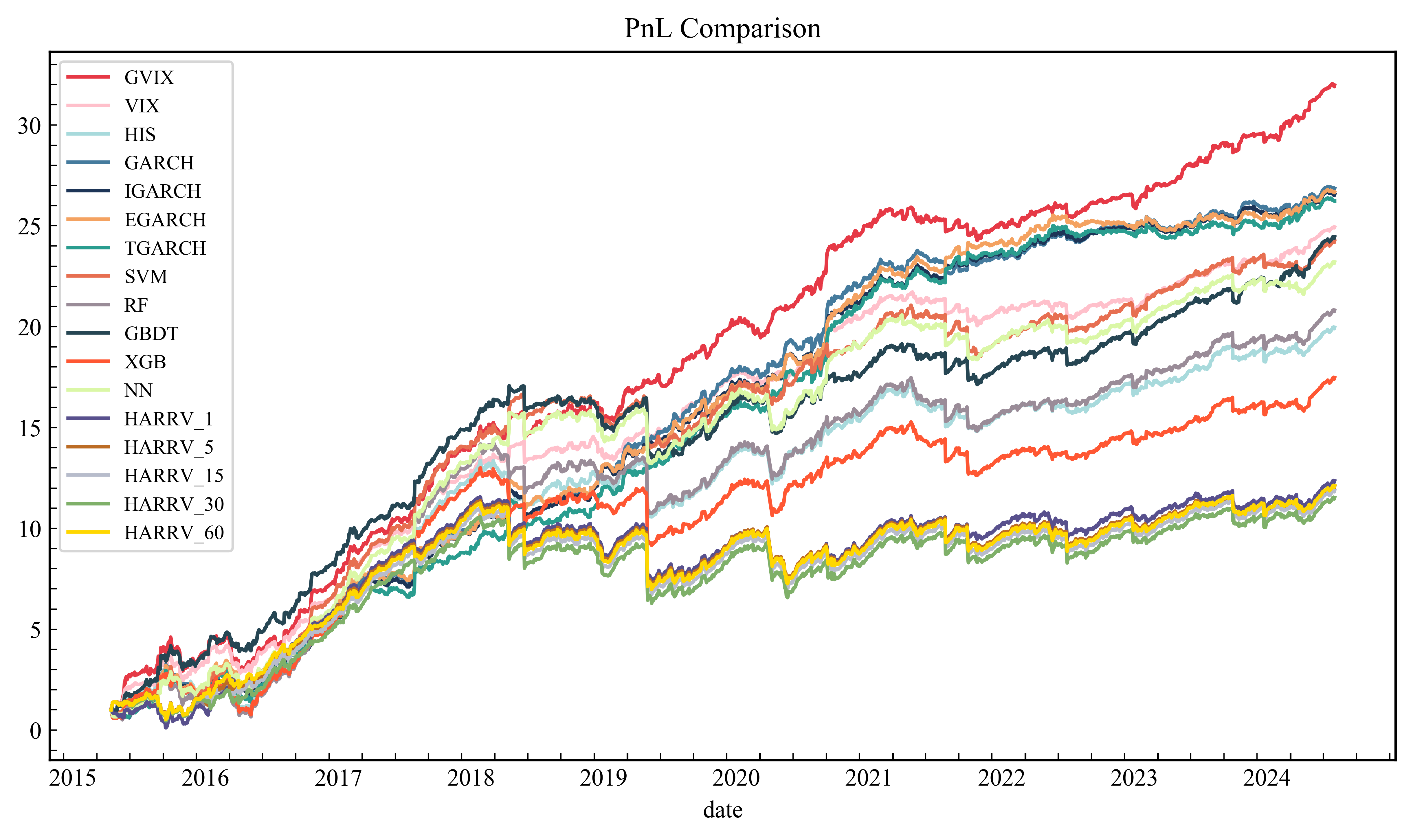

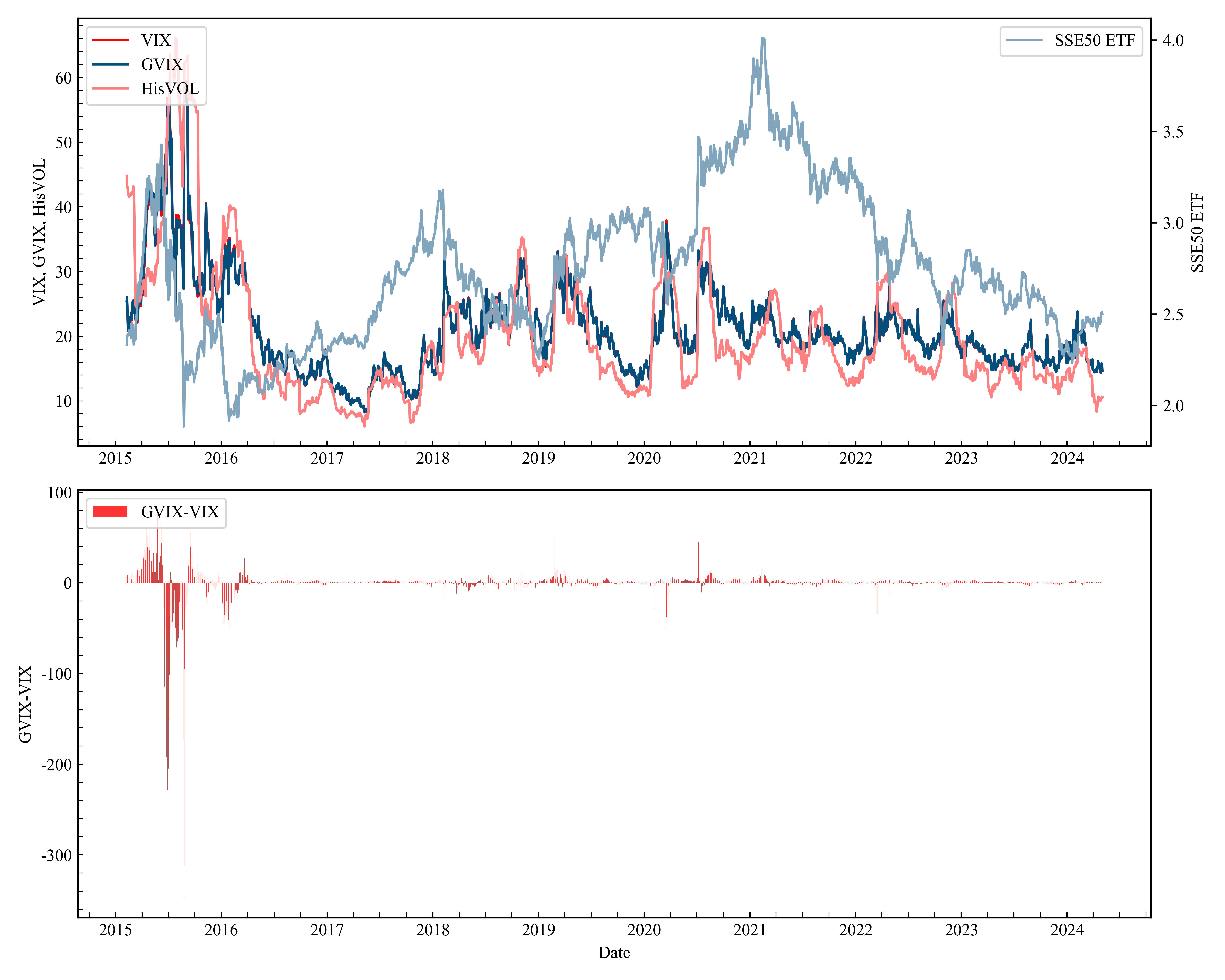

This paper introduces a novel approach to constructing a generalized volatility index (GVIX) for the Chinese market, diverging from the geometric Brownian motion assumption underlying the traditional VIX index. The study investigates the properties of GVIX in the Chinese market, drawing on existing literature. It concludes with a comparison of GVIX against other volatility indices by assessing the performance of option trading strategies utilizing each index as the implied volatility input. The findings indicate that GVIX-based strategies achieve the highest annualized returns of 47.62% and a competitive Sharpe ratio of 1.94, suggesting that GVIX provides effective volatility information for option pricing.

- Novel GVIX Construction: A new method for constructing a GVIX that does not rely on the geometric Brownian motion assumption.

- Market Properties Examination: Analysis of GVIX properties in the Chinese market with reference to existing literature.

- Performance Comparison: GVIX is compared with other volatility indices based on the performance of option trading strategies using each index as the implied volatility input.

- Annualized Returns: GVIX-based strategies achieve the highest annualized returns of 47.62%.

- Sharpe Ratio: A competitive Sharpe ratio of 1.94, indicating the effectiveness of GVIX in providing volatility information for option pricing.

- In Peer Review: Pacific Basin Finance Journal

- GVIX Construction Code: Available upon request.

- Manuscript and Latex Code: Available after accepted by the journal.