We will be creating an algorithmic crypto trading bot that will use the Kraken API to get crypto prices. We will use machine learning to determine the trend of the market from historical data and determine the best strategies/indicators to use.

Our bot will also be deployed to a server doing paper trading runs to see how well the bot could do if it was in a live setting. During the paper trading run, it will also utilize machine learning to determine if the entries/exits are appropriate or not.

The data we're analyzing comes from a jupyter notebook that we'll create and import files to. We'll also be using Python to run and read our data.

-

Google Colab - Online jupyter notebook that enables us to run the code.

-

SVM - Machine Learning techniques to train our model data.

-

Naive Bayes - Machine Learning techniques to train our model data.

A list of imports and calls made for our code to run successfully.

import base64

import fire

import hashlib

import hmac

import importlib

import json

import krakenex

import numpy as np

import pandas as pd

import questionary

import requests

import re

import Source.Bot as bot

import urllib.parse

from pykrakenapi import KrakenAPI

from API.Endpoints import KrakenEndpoints

from API import KrakenRequests

from finta import TA

from Helper import Utilities as util

from matplotlib.pyplot import plot

from pandas import DataFrame

from pandas.tseries.offsets import DateOffset

from pykrakenapi import KrakenAPI

from os import listdir

from os.path import isfile

from sklearn import svm

from sklearn import naive_bayes

from sklearn.naive_bayes import ComplementNB

from sklearn.preprocessing import StandardScaler

from sklearn.metrics import classification_report, confusion_matrix

from Source.BaseStrategy import BaseStrategy

from Source.Kraken import Kraken- Pulled data from the Kraken Public API.

- Grabbed all OHLC data and created a list within a dataframe for analysis.

-

Our strategy will utilize SVC to predict ideal entry and exit signals for the trading bot.

-

We decided on using Support Vector Machines, more precisely, Support Vector Classifiers (SVC), in our trading algorithm as it handles large datasets effectively and efficiently.

-

Major Findings

-

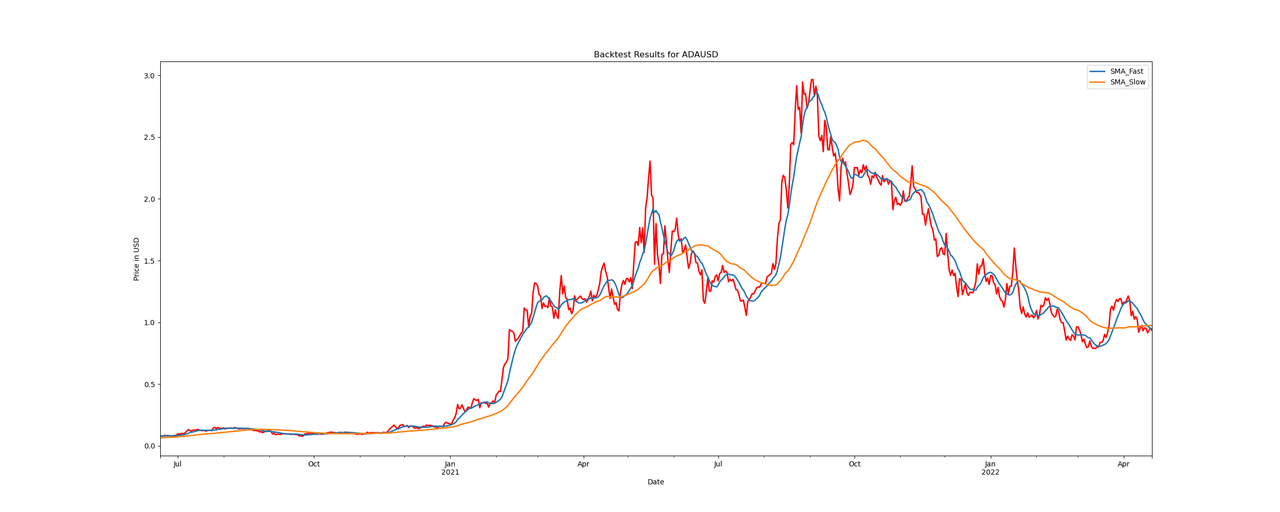

Based on some backtesting runs, the bot did not perform too well, but there is room for improvement.

-

As for optimization, we could improve the training and test data as there may be some overfitting or underfitting issues.

-

-

Conclusion

- As of now, our trading strategy only contains the strategy itself and a machine learning algorithm to determine entries and exits. A major factor in determining the success of a trading strategy is to also include risk management, as in calculate position sizing, stop-losses, take-profits, diversification of trades, along with numerous other factors.

Brought to you by Angel Reyes, Elgin Braggs Jr., Kevin Scott, and Victor Dang

MIT